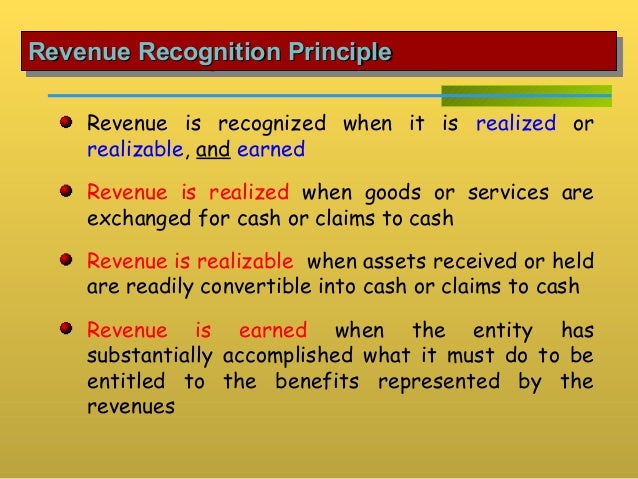

IFRS recognizes interest, royalties, and dividends when it is probable that the economic benefits associated with a transaction will flow to a company and the revenue can be reliably measured.Īccording to US GAAP, revenue is recognized when it is “realized or realizable and earned”.

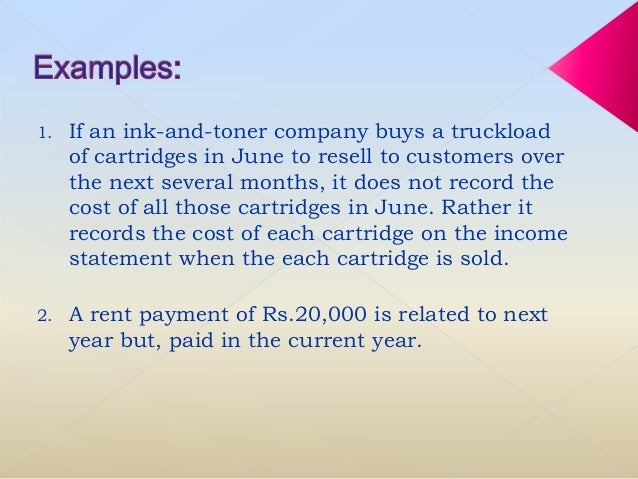

the company has transferred the significant risks and rewards of ownership of the goods to the buyer.General Principles of Revenue RecognitionĪccording to IFRS, a company should recognize revenue from the sale of goods whenever the following conditions are satisfied: It is useful to review these policies to understand how and when a company recognizes revenue, especially when making comparisons with other companies. Accrual accounting allows revenue to be recognized, i.e., reported on the income statement when it is earned, and not necessarily when cash is received.Ĭompanies disclose their revenue recognition policies in the notes to their financial statements. Revenue is reported on the top line of the income statement.

0 kommentar(er)

0 kommentar(er)